For all other investment income ie interest foreign income and taxable capital gains 3067 per cent of that income is also added to the RDTOH account. From 20000 to 35000.

Chapter 5 Non Business Income Students

Taxable Income MYR Tax Rate.

. Income tax calculators from other sites may show slightly different numbers due to different. This allows the REIT to distribute its income on a gross basis. Key points of Malaysias income tax for individuals include.

From 5000 to 20000. Gross income consists of all forms of taxable income eg. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020.

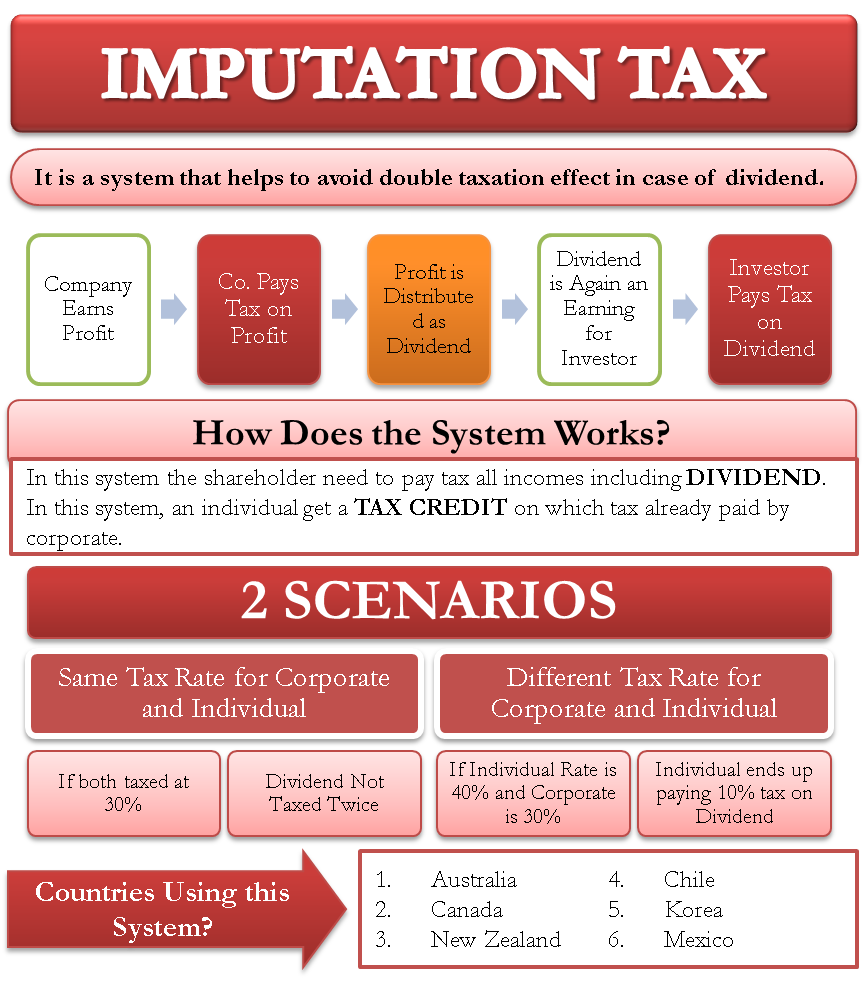

Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. The tax credit amount that can be claimed depends.

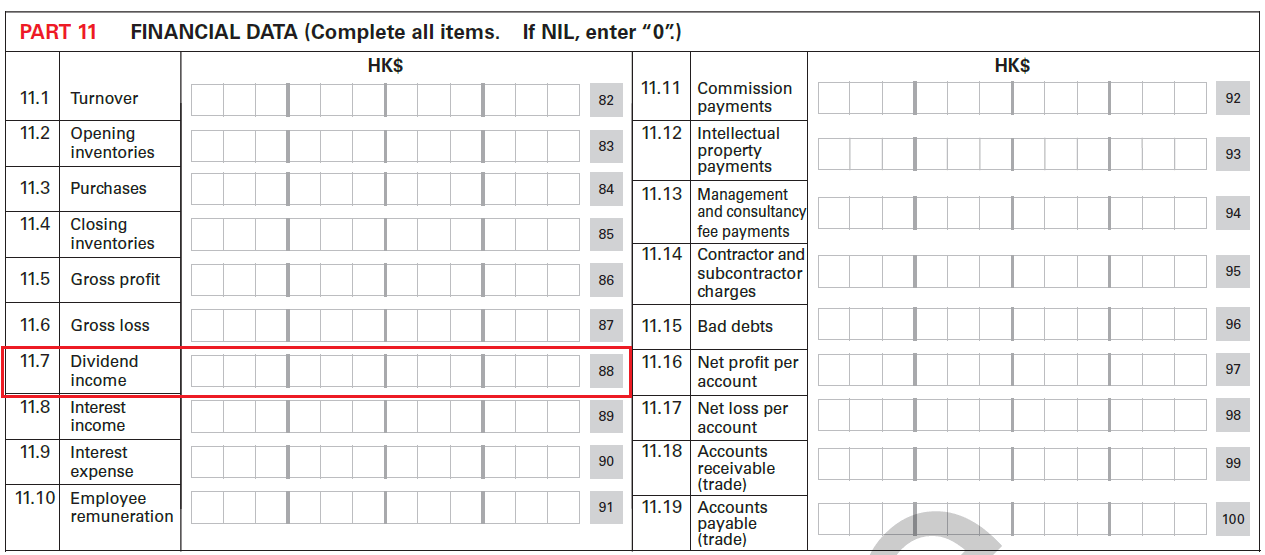

Other income is taxed at a rate of 30. When the corporation pays a taxable dividend to shareholders itll receive a tax refund of 1 for every 261 of dividends paid up to the balance of the RDTOH account. Philippines and sold in Hongkong Compensation received for personal services in the Philippines 200000 Rent income from real property in Malaysia 300000 Gain from sale in the Philippines of shares of a foreign.

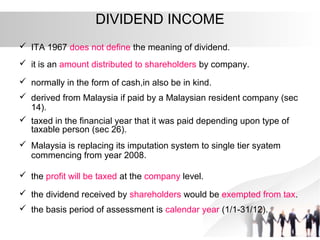

As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. The Income Tax Ordinance was the first law on Income Tax which was promulgated in Pakistan from 28 June 1979 by the Government of Pakistan.

For tax credits investors must fill out Form 1116 which can get complicated. However income of a resident company from the business of airsea transport banking or insurance is taxed on a worldwide basis. Dividend paid by a resident company of a contracting state to a resident of the other contracting state may be taxed in that other state.

The Income Tax Ordinance 2001 edit To update the tax laws and bring the countrys tax laws into line with international standards the Income Tax Ordinance 2001 was promulgated on 13 September 2001. Salary bonuses stock or share-based income foreign-service premiums cost-of-living allowances tax reimbursements and other benefits in kind except for certain tax-exempt items are classified as taxable. Itemized reductions will reduce taxable income while an income tax credit can actually be used to pay off tax liabilities.

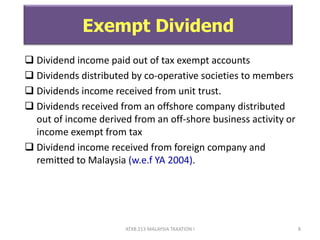

Nonresidents are subject to withholding taxes on certain types of income. Income from employment investment rental real estate. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

If a US Company pays a dividend to an Indian Resident shareholder then. When a stockholder receives a stock dividend which is taxable income. The taxable income of the corporation in 2020 should be.

Malaysia Income Tax Brackets and Other Information. For 2021 tax year. Capital gains tax dividend tax etc.

With this tax system most Malaysian REITs if not all distributes at. Taxation on a worldwide basis does not apply when income. Tax rates range from 0 to 30.

What S Your State S Dividend Income Tax Thinkadvisor

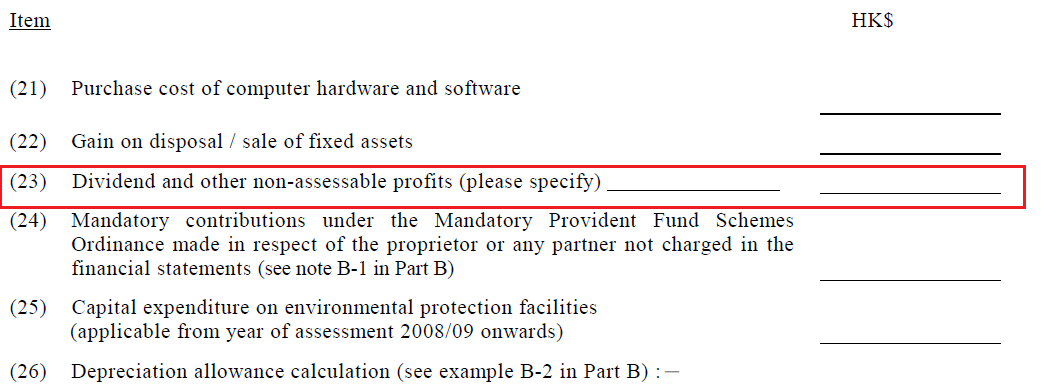

Dividend Income In Hong Kong Startupregistry Hk

How Much Do You Need To Invest To Get Dividend Income Save Spend Splurge Dividend Income Investing Dividend

Taxation Of Dividend Income And Capital Gains

Taxation Of Dividend Income And Capital Gains

Imputation Tax Meaning How It Works And More

What Is Dividend Yield Definition Formula Usefulness For Investors

Browse Our Sample Of Dividend Payment Voucher Template Dividend Templates Voucher

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Taxation Principles Dividend Interest Rental Royalty And Other So

How Much Money Do You Need To Have Invested To Live Off Dividends By Marcus Tan Geek Culture Medium

Dividend Definition Examples And Types Of Dividends Paid

Dividend Income In Hong Kong Startupregistry Hk

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Payment